European Union Imitation Whipped Cream Market to Reach USD 304.7 Million by 2035 — Demand Surges Across Foodservice

Demand for imitation whipped cream in the EU is set to grow steadily, driven by changing consumer preferences and the rise of plant-based alternatives.

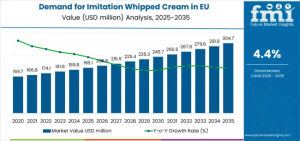

NEWARK, DE, UNITED STATES, November 7, 2025 /EINPresswire.com/ -- According to the latest market intelligence published by Future Market Insights, imitation whipped cream sales across the European Union are projected to grow from USD 198.1 million in 2025 to USD 304.7 million by 2035, reflecting an absolute increase of USD 105.7 million over the assessment period. The category is expected to expand at a steady 4.4% CAGR, supported by the rising demand for cost-efficient dessert topping alternatives, growth of plant-based offerings, and higher commercial adoption in bakeries, cafés, quick-service restaurants, and institutional catering environments.

Future Market Insights notes that the EU market is set to scale by nearly 1.5X between 2025 and 2035 as convenience dessert formats and non-dairy alternatives become mainstream across commercial kitchens and retail households.

Quick Statistics (EU Market — Future Market Insights, 2025 Update)

• Market value (2025): USD 198.1 million

• Forecast value (2035): USD 304.7 million

• CAGR (2025–2035): 4.4%

• Top product format: Powder (78%)

• Leading application: Foodservice (55%)

• High-growth countries: Netherlands, France, Rest of Europe

Commercial Adoption Accelerates as Operators Prioritize Cost Efficiency

Between 2025 and 2030, sales are forecast to rise from USD 198.1 million to USD 245.5 million, accounting for 44.8% of the decade’s growth. This momentum is attributed to:

• Higher adoption of convenient dessert toppings

• Increasing cost-efficiency demand in cafés and bakeries

• Broader acceptance of dairy-free whipped toppings

From 2030 to 2035, growth intensifies, adding USD 58.3 million, driven by:

• Expansion of clean-label and organic varieties

• Integration of oat, coconut, and almond-based formulations

• Premiumization of non-dairy toppings with improved taste and texture

What Is Fueling Market Growth?

Imitation whipped cream offers critical operational benefits to commercial kitchens — including extended shelf life, reduced waste, ambient storage capability, and consistent batch performance. These advantages are now essential as the region's foodservice and bakery sectors face cost pressure and labor constraints.

Growing lactose intolerance awareness also plays a decisive role. Additionally, increasing regulatory clarity on non-dairy labeling and product standardization is improving consumer confidence and adoption.

Segment Analysis: Powder Format Dominates With 78% Share

Powdered imitation whipped cream accounts for 78% of sales in 2025, maintaining 76% share through 2035. Its dominance is due to:

• Ambient storage — eliminates refrigeration cost

• Reduced food waste due to extended shelf life

• Portion control for high-volume operators

The format is now widely utilized in dessert decoration, beverages, patisserie finishing, and bakery fillings.

Foodservice Remains the Primary Application (55% Share in 2025)

The foodservice channel is forecast to grow to 58% share by 2035, driven by demand from:

• Cafés and specialty bakeries

• Catering and institutional kitchens

• Quick-service restaurants requiring ready-to-use solutions

Convenience formats — aerosols, single-serve portions, and ready-to-use whipped toppings — are contributing strongly to the segment's expansion.

Regional Growth Leadership

Netherlands 5.0%

Rest of Europe 4.8%

France 4.5%

Italy 4.5%

Spain 4.1%

Germany 4.0%

Germany holds the largest market share (25.6%), elevated by its café and bakery culture. Meanwhile, the Netherlands leads growth, fueled by consumer receptiveness to convenience products and strong food innovation ecosystems.

Competitive Landscape Remains Consolidated Yet Innovation-Driven

The market is characterized by intense technical innovation and product differentiation.

Top participating companies include:

• Rich Products Corporation (≈18% share)

• Danone (≈12%)

• PURATOS (≈10%)

• Kerry Group (≈8%)

• Nestlé S.A. (≈7%)

• Schlagfix (Gebr. Hagemann GmbH & Co. KG)

• Conagra Brands, Lactalis International, FrieslandCampina, Hanan Products, and others

To Explore Detailed Market Data, Segment-Wise Forecasts, and Competitive Insights, Request Sample Report. https://www.futuremarketinsights.com/reports/sample/rep-gb-27113

To Access The Full Market Analysis, Strategic Recommendations, And Analyst Support, Purchase The Complete Report Here. https://www.futuremarketinsights.com/checkout/27113

Browse Related Insights

Imitation Whipped Cream Market: https://www.futuremarketinsights.com/reports/imitation-whipped-cream-market

Whipped Topping Concentrate Market: https://www.futuremarketinsights.com/reports/whipped-topping-concentrate-market

Cream of Tartar Market: https://www.futuremarketinsights.com/reports/cream-of-tartar-market

Why FMI: https://www.futuremarketinsights.com/why-fmi

Sudip Saha

Future Market Insights Inc.

+1 347-918-3531

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.