Europe’s Water Flavouring Drops Demand on a Steady Growth Path: Market to Reach USD 15.5 Billion by 2035

Rising health consciousness & preference for customizable, low-calorie hydration option are driving strong demand growth for water flavouring drop across the EU

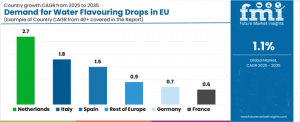

NEWARK, DE, UNITED STATES, November 7, 2025 /EINPresswire.com/ -- Demand for water flavouring drops in the European Union (EU) is rising steadily as consumers increasingly adopt healthier hydration habits and reduce dependence on sugary ready-to-drink beverages. According to industry projections, the EU water flavouring drops market is expected to expand from USD 13.9 billion in 2025 to USD 15.5 billion by 2035, reflecting a sustained growth rate of 1.1% CAGR.

This growth is driven by a powerful shift toward personalized, functional hydration, with consumers demanding natural, sugar-free, portable, and environmentally conscious beverage alternatives.

Health + Convenience = Persistent Growth Momentum

European consumers are increasingly seeking hydration solutions that combine flavour customization, calorie control, and functional benefits. Water flavouring drops allow consumers to adjust flavour intensity and sweetness while avoiding the sugar content associated with traditional beverages.

Rising scientific evidence linking hydration to better mental clarity, improved digestion, and enhanced physical performance is reshaping hydration behavior across EU households, gyms, and workplaces. The category benefits from two distinct purchase drivers:

• Necessity-driven adoption from consumers replacing sugary sodas and juices.

• Lifestyle-driven adoption from active and urban consumers seeking portable hydration enhancers.

Additionally, the regulatory environment fuels momentum. EU sugar reduction policies, clean-label mandates, and ingredient transparency requirements are advancing natural formulations and accelerating the shift toward organic and stevia-sweetened drops.

Production and Supply Chain Dynamics Strengthen Market Stability

In 2025, production assets are concentrated in Poland, Germany, Italy, and France, primarily through mid-sized co-packing partners. Manufacturers focus on automation, flexible batch sizes, and packaging efficiencies, rather than new plant constructions.

Raw material sourcing relies on:

• High-intensity sweeteners, mainly stevia glycosides, aspartame, and sucralose

• Citric and malic acids, supporting acid balance and flavour stability

• Natural extracts and artificial flavours, supplied by speciality flavour houses

• PET, rPET, and glass packaging formats, aligned with recyclable materials strategy

To respond to pricing volatility in agricultural inputs and resin-based packaging, companies increasingly adopt dual sourcing, hedging strategies, vendor-managed inventory, and safety stock models.

Innovation Drives Product Premiumization

Manufacturers are moving from basic flavour enhancers to functional hydration solutions, incorporating vitamins, herbal extracts, electrolytes, and adaptogens. This shift allows brands to achieve premium pricing and improve retention rates across D2C subscription models.

By 2035:

• Organic variants grow from 24% to 34% share of total sales.

• Stevia-sweetened products rise from 70% to 72% share, reinforcing their leadership position.

Stevia-based drops continue to outperform due to improvements in taste masking and multi-glycoside blends that eliminate bitterness and mimic sugar mouthfeel.

Digital Distribution Redefines Consumer Engagement

Online sales are projected to climb from 25% in 2025 to 35% by 2035. Digital-first brands are winning through subscription programs offering monthly flavour variety, hydration tracking, and tailored replenishment schedules.

E-commerce and D2C channels enable:

• Direct access to consumer purchasing insights

• Rapid flavour testing and micro-segmentation

• Higher repeat purchase rates vs. retail-only sales models

Sustainability Becomes a Strategic Growth Lever

EU consumers view water flavouring drops as an environmentally superior alternative to bottled drinks because a 30 ml concentrated pack can replace up to 20 plastic bottles. Circular packaging efforts include lightweight bottles, mono-material closures, refill cartridges, and rising PCR content adoption.

Brands piloting refillable pouches and returnable packaging are earning traction, particularly in Germany, Netherlands, and Nordic countries.

Netherlands Leads EU Growth — Germany Remains the Largest Market

• Netherlands posts the fastest growth rate with 2.7% CAGR due to high e-commerce adoption and sustainability-focused consumers.

• Italy and Spain show robust growth tied to evolving beverage habits and strong fitness culture.

• Germany, growing at 0.7% CAGR, remains the EU’s largest market, supported by mature retail penetration and strong organic adoption.

• France follows a premiumization path, with consumers prioritizing natural flavours and gastronomy-grade taste profiles.

See How This Report Can Support Your Strategic Planning. Request Sample Report With Complete Market Breakdowns And Growth Estimates. https://www.futuremarketinsights.com/reports/sample/rep-gb-27231

For Customized Insights And Licensing Options, Get The Full Report. Purchase Full Report: https://www.futuremarketinsights.com/checkout/27231

Competitive Landscape

The EU market remains fragmented, with global beverage leaders, flavour manufacturers, and digitally native D2C brands competing aggressively. Key players include:

Waterdrop (EU), The Coca-Cola Company, Wisdom Natural Brands, Capella Flavours, Pure Flavour GmbH, Kraft Heinz (MiO), Nestle, Soda Stream International, Britvic plc, and Twinings.

Waterdrop leads with an estimated 10% market share, driven by subscription ecosystems, microdrink flavour cubes, and sustainable packaging.

Browse Related Insights

Water Flavouring Drops Market: https://www.futuremarketinsights.com/reports/water-flavouring-drops-market

Flavor Drops Market: https://www.futuremarketinsights.com/reports/flavor-drops-market

Why FMI: https://www.futuremarketinsights.com/why-fmi

Sudip Saha

Future Market Insights Inc.

+1 347-918-3531

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.